What's It Worth?

"What's it worth?" It is a question that many people who are new to gun trading ask. If it is asked of a dealer, he will give an answer that allows him to make a profit on resale. If it is asked of a collector his answer will be influenced by what he has seen like examples sell for. If asked of a shooter, his answer will be dependent on how accurate the gun is. If asked of a soldier, his answer will be related to the durability and reliability of the weapon. When the query receives an unsatisfactory answer, the questioner often recoils indignantly and accuses the person responding of trying to "rip them off". If the truth is told, it simply a matter of two people evaluating the same object of desire differently.

"What's it worth?" It is a question that many people who are new to gun trading ask. If it is asked of a dealer, he will give an answer that allows him to make a profit on resale. If it is asked of a collector his answer will be influenced by what he has seen like examples sell for. If asked of a shooter, his answer will be dependent on how accurate the gun is. If asked of a soldier, his answer will be related to the durability and reliability of the weapon. When the query receives an unsatisfactory answer, the questioner often recoils indignantly and accuses the person responding of trying to "rip them off". If the truth is told, it simply a matter of two people evaluating the same object of desire differently.What these new gun traders fail to understand is there are no set prices for guns. There are price guides galore that tell what people have given in the past for guns. New gun traders often consider these guides to be absolute, often demanding that the other trader match prices shown in print. Price guides are not absolute standards. Even under the best circumstances, the listings are over a year old. When a company such as Colt ceases revolver production, the price guides will not reflect the ripple effect in Colt revolver (and S&W revolver) prices until it is past history. Price guides list what various guns sold for, on average, across the United States during a specific period of time prior to publication. If one wants to trade effectively in the gun market, then one needs to understand this, and stay ahead of the price guides. They are guides, not gospel.

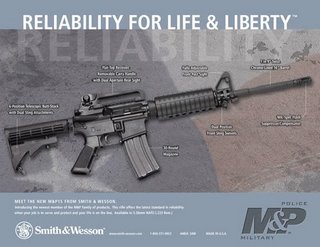

Guns are not a commodity standard such as gold or gems. On the world market, even gold and gems have fluctuating prices. Should we consider guns to have a less volatile index than other commodities? No. In the United States, gun prices are affected by many variables. Of course there is supply and demand, but what drives the demand? One of the variables is advertisement. New gun prices are driven by desire, which is driven by advertisement. Crime rates and natural disasters affect supply and demand. New laws and bans on items such as full capacity magazines can affect demand drastically. Prices on different guns vary widely in different regions of the country. Indeed, some dealers make money just by buying in one area and selling in another.

Guns are not a commodity standard such as gold or gems. On the world market, even gold and gems have fluctuating prices. Should we consider guns to have a less volatile index than other commodities? No. In the United States, gun prices are affected by many variables. Of course there is supply and demand, but what drives the demand? One of the variables is advertisement. New gun prices are driven by desire, which is driven by advertisement. Crime rates and natural disasters affect supply and demand. New laws and bans on items such as full capacity magazines can affect demand drastically. Prices on different guns vary widely in different regions of the country. Indeed, some dealers make money just by buying in one area and selling in another. There are several ways of looking at gun values. Some ways are from a seller's point of view, some ways are from the buyer's viewpoint.

Guns have no intrinsic value past their use as projectile launchers. In that realm of thinking, a Colt Gold Cup has the same value as a Hi Point 45. Both will launch a .45 caliber bullet into space. Period. That may sound like heresy to some, and to tell the truth, it pains me to say it. The guns do the same job though. A buyer who approaches the market with this view will find himself quickly ostracized and ignored. When the levees break and looters roam the night however, this view prevails.

In a more normal marketplace, the price of specific firearms is driven by desire. There are some guns that will always illicit a higher desire in the marketplace than others. These include any guns that were issued in wartime.

M1911s, Colt 1917s, Victory Model M&Ps, and yes, eventually the Beretta M9. The prices of these wartime guns are often low simply because the production was extremely high. The interest never wanes, however. When a politician such as Bill Clinton comes along and destroys all the M1911s available for disposal, the resulting price spike of those remaining examples outside his destructive power can be significant. Other guns, such as pinned and recessed Smith & Wesson revolvers may have a higher desirability because they are seen as being of superior quality. Registered Magnum revolvers enjoy both the quality and historical aspects, and thus command top dollar in the marketplace.

M1911s, Colt 1917s, Victory Model M&Ps, and yes, eventually the Beretta M9. The prices of these wartime guns are often low simply because the production was extremely high. The interest never wanes, however. When a politician such as Bill Clinton comes along and destroys all the M1911s available for disposal, the resulting price spike of those remaining examples outside his destructive power can be significant. Other guns, such as pinned and recessed Smith & Wesson revolvers may have a higher desirability because they are seen as being of superior quality. Registered Magnum revolvers enjoy both the quality and historical aspects, and thus command top dollar in the marketplace. As seen on the gulf coast however, the firearm marketplace can change drastically with the weather. If a New Orleans resident owned a Registered Magnum in August 2005, he might gladly trade it for a Glock 22 and two boxes of ammo a month later, and say "Thank you sir." In a time of crisis, the desirability of a firearm rests solely on it's ability to defend life and property. If the Registered Magnum owner held out for $1500 along with that Glock, or perhaps three more Glocks, he would have been laughed at in the wake hurricane Katrina. During natural disasters, capacity, durability and firepower mean everything. What the gun might sell for next year means very little if you might not make it to next year yourself.

For me, I understand that a gun is worth only what I can sell it for when I need money and few people are buying guns. I am, however, affected by the aesthetic and historical qualities of a firearm. I find pleasure in owning and holding a historical firearm just as my wife finds pleasure in antique furniture. I like to shoot my guns just as she likes to set an antique table with antique china and silver. I will pay more for a gun with a history or even a gun with alterations that interest me from an aesthetic viewpoint. To others, these guns may be worthless. I am not buying for investment, however. I am buying for enjoyment. Thus I only buy what I like, and I decide whether I like it. I will pay a premium to get what I like. Thankfully, I often do not have to. That makes it all the more enjoyable.

For me, I understand that a gun is worth only what I can sell it for when I need money and few people are buying guns. I am, however, affected by the aesthetic and historical qualities of a firearm. I find pleasure in owning and holding a historical firearm just as my wife finds pleasure in antique furniture. I like to shoot my guns just as she likes to set an antique table with antique china and silver. I will pay more for a gun with a history or even a gun with alterations that interest me from an aesthetic viewpoint. To others, these guns may be worthless. I am not buying for investment, however. I am buying for enjoyment. Thus I only buy what I like, and I decide whether I like it. I will pay a premium to get what I like. Thankfully, I often do not have to. That makes it all the more enjoyable.More info

Labels: Gun Collecting, Gun Tradin'

4 Comments:

Damn good post.

Disclaimer: I am not an avid gun trader (IANAAGT?)

This is a market like any other. It's worth what you can get for it at the time you want to sell it. The problems you're describing with new traders all seem to stem from the fact that the used gun market isn't very liquid (as opposed to shares of MSFT, which are very liquid). Market liquidity normalizes prices. You have lots of other "comps". A true comparable transaction would be for the same gun in the same condition, under the same terms sold in the last minute or so. Change any of those variables and the "comp" is a less accurate guide for the current transaction. Good post.

Auction Arms is often an excellent price guide; you can search their database to see what similar examples have actually sold for in the last 90 days.

Obviously, these prices will change, but the AA data is always more current than any printed price guide. The only disadvantage is that the data can be sparse for uncommon guns.

You made me sign up to post with a name. Usually, I can ignore most Blogs but your Blog is worth my time in reading (and deserves to be recognized as such).

Thanks

Post a Comment

<< Home